Elevation Certificates and Flood Plain Consulting Services

Elevation Certificates and Flood Plain Consulting Services

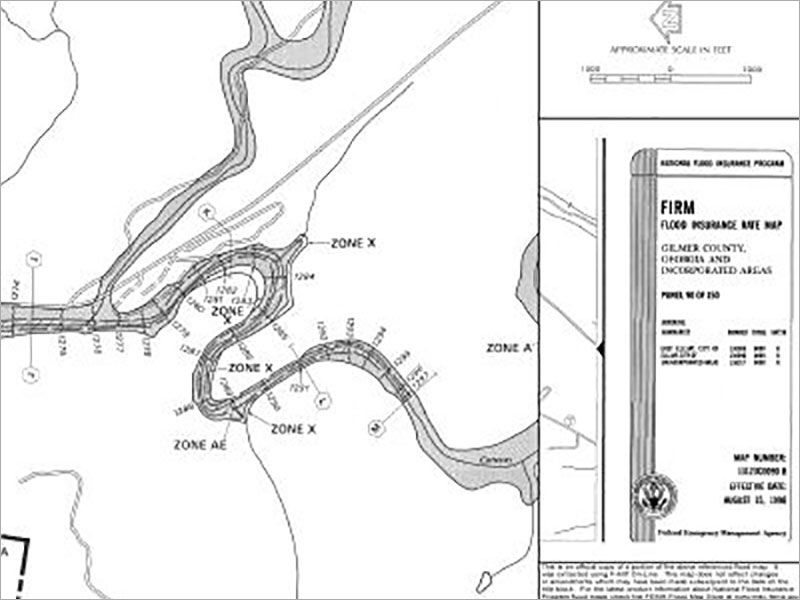

Elevation Certificates are forms published by FEMA (FEMA Form 81-31) that must be completed and certified with specific elevation and location reporting data. They are required by insurance companies to rate flood insurance policy premiums. They are also required by building inspectors when building within a flood hazard area. The scope of service for completing an Elevation Certificate can vary greatly according to the flood zone that the property is located in and the extent of elevation surveying that may be necessary. Our Elevation Certificates are completed and sent in PDF format for expedited handling by insurance and lending institutions.

Sometimes it is discovered that homes or buildings have been mapped within flood hazard areas when in fact they are not. This situation still requires flood insurance according to FDIC requirements. But, a Letter of Map Amendment, also referred to as a “LOMA” application can often be used to remove a specific structure or parcel of land from a mapped flood hazard area. Some structures in zone AE are eligible for eLOMA, which is an automated filing platform that can be processed in days instead of the customary several weeks. Once a LOMA has been issued, the mandatory requirement for flood insurance is dropped by the lender according to FDIC regulations. In most situations we recommend that property owners take advantage of the preferred risk lower premiums and maintain flood insurance after a LOMA has been issued if the structure is in close proximity to a flood plain.

Chastain & Associates, P.C. has performed many elevation certificates, LOMA applications, and has even worked directly with FEMA and the state Floodplain Management office on regulatory and corrective action projects.

We encourage you to submit your information through our expedited online quote request form, but you can feel free to email or call our office and speak to one of our experienced staff members if you need to. Chastain & Associates, P.C. has the experience and necessary training, equipment, qualifications and manpower to provide accurate and legal surveys in 5 states.